The Baltic Dry Index

The BDI average for May was 976. Year to date (YTD), the index has averaged 1,003. In the same period last year the BDI average was 457. The BDI is a shipping and trade index created by the London-based Baltic Exchange that measures changes in the cost to transport raw materials.

The Baltic Dry Index offers a forward view into global supply and demand trends. A rising index can indicate a strengthening global economy. A contracting BDI index signals a slow-down. The BDI includes three component ships: Capesizes, Panamaxes and Supramaxes. Capesize ships are the largest, Supramaxes are the smallest. Capesizes and Panamaxes account for the vast majority of steel and its raw material freight.

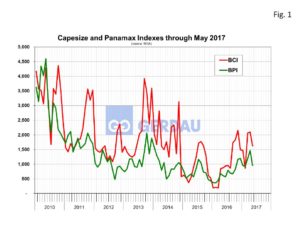

Figure 1 illustrates this volatility for both Capsize and Panamax indexes. In 2008 the Capsize index spiked to over 18,000, just before the great recession ensued. Yesterday (June 1st), the Capsize index was 1,430, it was 861 on one year ago and 1,779 a month ago. The Panamax today’s index stands at 810, it was just 658 on one year ago and 1,187 a month ago.

Figure 1 illustrates this volatility for both Capsize and Panamax indexes. In 2008 the Capsize index spiked to over 18,000, just before the great recession ensued. Yesterday (June 1st), the Capsize index was 1,430, it was 861 on one year ago and 1,779 a month ago. The Panamax today’s index stands at 810, it was just 658 on one year ago and 1,187 a month ago.

Despite the recent rise, the BDI is still low by historic comparison. It is typical for the BDI to lose value starting in late spring, with the losses continuing through the summer as shipping activity quiets. Analysts are expecting the BDI’s downward trend to continue in the coming weeks based on thinner cargoes and the fact that shipbuilding companies are receiving more orders for new bulk carrier construction. The lower demand expectations are based on the belief that China’s infrastructure building will slow later in the year. Concerns about China have increased since Moody’s recent downgraded of its credit from A1 to Aa3. This was the country’s first downgrade in 30-years.

China is the 800 pound gorilla when it comes to seaborne trade. China’s demand for raw materials, combined with its geographic location and the fact that it does not produce enough raw materials domestically to meet its demand dictates that it has to import these goods. China has been trying to maintain its GDP growth by financing infrastructure programs with debt. Since the state owned enterprises owns the debt, any future need to stimulate the economy would be difficult to achieve. If China’s economy stalls it would be disastrous for the BDI.

At Gerdau we regularly monitor the Baltic Dry index since it is a leading indicator of demand for goods on a global scale. An increasing BDI signals stronger global trade which can be good for domestic business if the transactions are fairly traded.