Architectural Billings Index

The national ABI score for December fell-back from November’s 55.0 to 52.9 in December. This score still reflects an increase in design services provided by U.S. architecture firms. It also marks three consecutive months of readings of growth in design billings. The new projects inquiry index was 61.9, up 0.8 of a point from last month, while the new design contracts index decreased 0.5 of a point to 52.7. Regional monthly scores were: South 56.3, West 53.0, Midwest 52.9 and Northeast 49.4.

The Architecture Billings Index (ABI), is a leading economic indicator that provides an approximately nine to twelve month glimpse into the future of nonresidential construction spending activity. The results are seasonally adjusted to allow for comparison to prior months. Scores above 50 indicate an aggregate increase in billings, and scores below 50 indicating a decline.

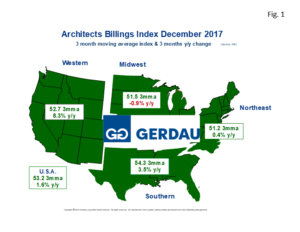

Figure 1 presents a map of the U.S. depicting the four ABI regions. It is color coded to show expanding billings and increased growth in green and declining billings and negative growth in red. The data is shown on this map is as three month moving averages (3MMA), and 3 month year on year (y/y), percent change.

Figure 1 presents a map of the U.S. depicting the four ABI regions. It is color coded to show expanding billings and increased growth in green and declining billings and negative growth in red. The data is shown on this map is as three month moving averages (3MMA), and 3 month year on year (y/y), percent change.

On a 3MMA basis, the U.S. ABI score was 53.2 with a 1.6% annual growth rate. The Southern region posted the highest 3MMA ABI at 54.3, with an annual growth rate of 3.5%. The Western region recorded a 3MMA of 52.7 and a strong annual growth rate of 8.3%. The Northeast recorded a 51.2, 3MMA ABI, its annual growth rate improved by 0.4%. The Midwest zone scored a 51.5, 3MMA, however its annual growth rate declined by 0.9% y/y.

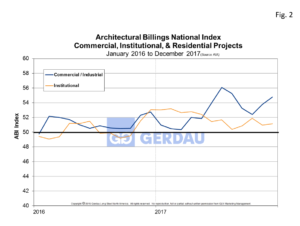

Figure 2  charts the ABI sub-index for Commercial / Industrial and Institutional from 2016 to present. The Commercial/Industrial sub-index improved 1.0 point month on month to 54.8 in December. The index has now been greater than 50 for 23 consecutive months. The Institutional sector scored a 51.2, up 0.2 of a point m/m, its 14th consecutive month greater than 50. The non-residential construction market has now posted twelve month-moving-total, (12MMT) growth for 71 consecutive months according to construction put in place, (CPIP) data from the U.S. Census Bureau.

charts the ABI sub-index for Commercial / Industrial and Institutional from 2016 to present. The Commercial/Industrial sub-index improved 1.0 point month on month to 54.8 in December. The index has now been greater than 50 for 23 consecutive months. The Institutional sector scored a 51.2, up 0.2 of a point m/m, its 14th consecutive month greater than 50. The non-residential construction market has now posted twelve month-moving-total, (12MMT) growth for 71 consecutive months according to construction put in place, (CPIP) data from the U.S. Census Bureau.

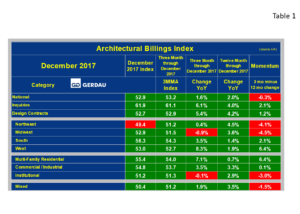

Table 1 lists the overall ABI and all of its sub-indexes. It presents and compares monthly and 3MMA data, showing percentage point change on both three and 12 month basis, as well as momentum. Green denotes positive change, while red indicates negative growth. National momentum, (3 month y/y subtract 12 month y/y) was slightly negative, at -0.3%.

Table 1 lists the overall ABI and all of its sub-indexes. It presents and compares monthly and 3MMA data, showing percentage point change on both three and 12 month basis, as well as momentum. Green denotes positive change, while red indicates negative growth. National momentum, (3 month y/y subtract 12 month y/y) was slightly negative, at -0.3%.

Inquiries momentum was higher by 2.1%. Design contract momentum gained 1.2%. Regionally, momentum was mixed with two of the four zones posted positive momentum; The Northeast recorded negative 4.1% momentum, while the Midwest recorded a negative 4.5% momentum. The South’s momentum was positive 2.1% as the West posted momentum at positive 6.4%. Momentum for the remaining project categories was mixed: Multi-family residential, (+6.4%), Commercial / Industrial, (-0.3%), Institutional, (0.1%) and Mixed-use, (-1.5%).

In its release today, AIA Chief Economist, Kermit Baker, Hon. AIA, PhD, quoted the following:

Overall, 2017 turned out to be a strong year for architecture firms. All but two months saw ABI scores in positive territory,” “Additionally, the overall strength of the fourth quarter lays a good foundation for healthy growth in construction activity in 2018.”

At Gerdau we follow the ABI because it is a leading indicator of non-residential construction activity. The ABI has a proven track record and as such it is useful for business planning purposes.