Architectural Billings Index

The national ABI score for April was 50.9 (any score above 50 indicates an increase in billings). The ABI has been greater than 50 for three of months in a row and for five of the last six months. The Federal Reserve’s Beige Book reports that non-residential construction is strong in most parts of the country. It also mentioned that residential construction is on the rise but that the pace of growth has slowed over the last couple of months.

The American Institute of Architects, advises that the ABI typically leads construction put-in-place (CPIP), numbers by 9 to 12 months.

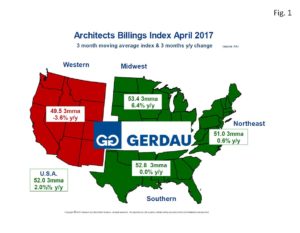

The four regions of the country all reported expanding billings in April. The South recorded the strongest score at 55.3, followed by the Midwest at 53.3, the West at 50.9 and the Northeast at 50.7.  Figure 1 presents a map of the US depicting the four ABI regions. It is color coded to show expanding billings and increased growth in green and declining billings and negative growth in red. The data is shown on this map is as three month moving averages (3MMA), and 3 month year on year (y/y), percent change. On a 3MMA basis, the US ABI was 52.0 with a 2.0% growth y/y. The Midwest scored the highest ABI at 53.4 and the largest percentage growth at 6.4% y/y. The South recorded a 52.8 ABI but showed flat growth y/y, while the Northeast posted a 51.0 ABI, and 0.6% y/y growth. The West was the only region with slightly declining billings (49.5) and negative growth at -3.6% y/y.

Figure 1 presents a map of the US depicting the four ABI regions. It is color coded to show expanding billings and increased growth in green and declining billings and negative growth in red. The data is shown on this map is as three month moving averages (3MMA), and 3 month year on year (y/y), percent change. On a 3MMA basis, the US ABI was 52.0 with a 2.0% growth y/y. The Midwest scored the highest ABI at 53.4 and the largest percentage growth at 6.4% y/y. The South recorded a 52.8 ABI but showed flat growth y/y, while the Northeast posted a 51.0 ABI, and 0.6% y/y growth. The West was the only region with slightly declining billings (49.5) and negative growth at -3.6% y/y.

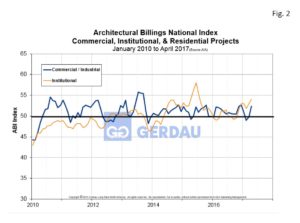

Figure 2  charts the ABI sub-index for commercial / industrial, institutional from 2009 to present. Commercial/Industrial moved up 2.6 points to 52.4 in April. Institutional scored a 54.0, its sixth month in a row greater than the 50. New design contracts increased by 0.9 points month on month to post a robust 53.2 score.

charts the ABI sub-index for commercial / industrial, institutional from 2009 to present. Commercial/Industrial moved up 2.6 points to 52.4 in April. Institutional scored a 54.0, its sixth month in a row greater than the 50. New design contracts increased by 0.9 points month on month to post a robust 53.2 score.

Overall the latest ABI report presented good news for the 9 to 12 month outlook for non-residential construction. Of significant concern going forward is a shortage of qualified tradesman and subcontractors. Several firms on the American Institute of Architects “work-on-the-boards” made reference to this issue. In a recent article from Moody’s, it made reference to the tightening labor situation, reporting that unemployment rates of less than 2% have been documented in some counties. This phenomenon is consistent with late cycle expansion and creates a dilemma for the FED, since the overheating is limited to certain sectors of the economy and is limited to specific geographic areas.