Architectural Billings Index

May’s ABI national overall score of 50.2 was down 0.3 points from April’s 50.5, but still in the expansionary zone, (>50). U.S. architecture firms with emphasis on commercial and industrial architect reported exceptional strong billings. Regionally activity was stronger in the Midwest and South. The new design contracts index decreased by 1.2 points to 50.9. Regional monthly scores were: South 51.4, West 50.0, Midwest 51.6 and Northeast 47.5.

The Architecture Billings Index (ABI), is a leading economic indicator that provides an approximately nine to twelve month glimpse into the future of nonresidential construction spending activity. The results are seasonally adjusted to allow for comparison to prior months. Scores above 50 indicate an aggregate increase in billings, and scores below 50 indicating a decline.

Figure 1 charts the ABI sub-index for Commercial / Industrial and Institutional from 2016 to present. The Commercial/Industrial sub-index increased sharply by 6.4 points (MoM) to 53.0 in May, a strong rebound from Aprils 46.6. The Institutional sector decreased by 1.2 points, scoring a 48.0 in April. This is the third consecutive month that the institutional index has been below 50.

Figure 1 charts the ABI sub-index for Commercial / Industrial and Institutional from 2016 to present. The Commercial/Industrial sub-index increased sharply by 6.4 points (MoM) to 53.0 in May, a strong rebound from Aprils 46.6. The Institutional sector decreased by 1.2 points, scoring a 48.0 in April. This is the third consecutive month that the institutional index has been below 50.

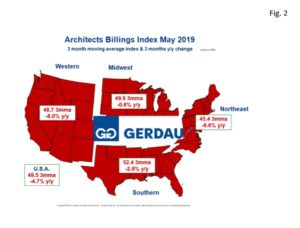

On a 3MMA basis, the national ABI score was 49.5 with a -4.7% annual growth rate. The Southern region posted the highest 3MMA of 52.4 with a growth rate of -2.8%

YoY. The Midwest region’s 3MMA ABI was 49.9, with an annual growth rate of -0.6%. The Western zone scored a 48.7, 3MMA, its annual growth rate was -8.0% y/y.

The Northeast recorded an ABI of 45.4, 3MMA. Its annual growth rate was negative 9.6%.

Figure 2 presents a map of the U.S. depicting the four ABI regions. It is color coded to show expanding billings and increased growth in green and declining billings and negative growth in red. The data is shown on this map is as three month moving averages (3MMA), and 3 month year on year (y/y), percent change.

presents a map of the U.S. depicting the four ABI regions. It is color coded to show expanding billings and increased growth in green and declining billings and negative growth in red. The data is shown on this map is as three month moving averages (3MMA), and 3 month year on year (y/y), percent change.

At Gerdau we follow the ABI because it is a leading indicator of non-residential construction activity with an approximate 12 month lead-time to ground-breaking. The ABI has a proven track record and as such it is useful for business planning purposes.