Architectural Billings Index

The national ABI score for March jumped to 54.3 (any score above 50 indicates an increase in billings), up 3.6 points from February’s 50.7. In an encouraging trend for future non-residential construction activity, the ABI has been greater than 50 for four of the last six months.

The American Institute of Architects, advises that the ABI typically leads construction put-in-place (CPPI), numbers by 9 to 12 months. Regionally the Midwest recorded the strongest score at 54.6, followed by the South at 52.6, the Northeast at 52.4. The West scored 50.2, crossing the 50 expansionary threshold up from last month’s disappointing 47.5.

Kermit Baker, American Institute of Architects Chief Economist made the following comments in today’s press release: “The first quarter started out on uneasy footing, but fortunately ended on an upswing entering the traditionally busy spring season. All sectors showed growth except for the commercial/industrial market, which, for the first time in over a year displayed a decrease in design services.”

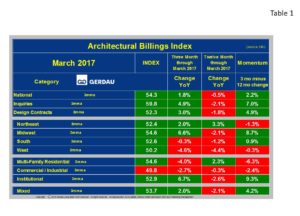

Table 1 examines the national and regional indexes as well as several sub-indexes. All data presented in the table are three month moving averages (3MMA), to smooth out volatility that regularly occurs with monthly data. The 3MMA of the national index was 54.3 in March, up 1.8% three months year on year (y/y), but down slightly, -0.5% when compared to 12 months ago. Commercial / Industrial slipped a fraction below the 50 value to score a 49.8, 3MMA, down 2.7% 3 month y/y and down 0.3% y/y. Institutional on the other hand posted a 52.9 score in March, up 6.7%, 3 months y/y with positive momentum of 9.3%. Design contracts are gaining strength registering a score of 52.3 in March, up 3.0%, 3 months y/y, also with positive momentum.

Table 1 examines the national and regional indexes as well as several sub-indexes. All data presented in the table are three month moving averages (3MMA), to smooth out volatility that regularly occurs with monthly data. The 3MMA of the national index was 54.3 in March, up 1.8% three months year on year (y/y), but down slightly, -0.5% when compared to 12 months ago. Commercial / Industrial slipped a fraction below the 50 value to score a 49.8, 3MMA, down 2.7% 3 month y/y and down 0.3% y/y. Institutional on the other hand posted a 52.9 score in March, up 6.7%, 3 months y/y with positive momentum of 9.3%. Design contracts are gaining strength registering a score of 52.3 in March, up 3.0%, 3 months y/y, also with positive momentum.

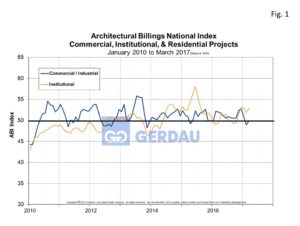

Figure 1 charts the ABI sub-index for commercial / industrial, institutional from 2009 to present. Commercial/Industrial is right at expansionary line. Institutional is well above the line, it fifth month in a row greater than the 50.

Figure 1 charts the ABI sub-index for commercial / industrial, institutional from 2009 to present. Commercial/Industrial is right at expansionary line. Institutional is well above the line, it fifth month in a row greater than the 50.

At Gerdau we follow the ABI because it is a leading indicator of non-residential construction activity. The ABI has a proven track record and as such it is useful for business planning purposes.