Architectural Billing Index

The national ABI score for July was 51.9, down 2.3 month on month, (> 50 indicates an increase in billings). The ABI has now been greater than 50 for six months in a row and for nine of the last 12 months. The new projects inquiry index was 59.5, up 0.9 point month on month and the design contracts index increased 2.7 percentage points month on month to 56.4.

All four regions of the country reported expanding billings in July. The South and Midwest tied for the strongest score with 53.8, followed by the Northeast at 53.6 and the West at 50.9.

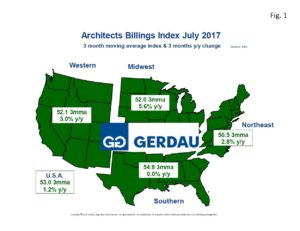

Figure 1 presents a map of the US depicting the four ABI regions. It is color coded to show expanding billings and increased growth in green and declining billings and negative growth in red. The data is shown on this map is as three month moving averages (3MMA), and 3 month year on year (y/y), percent change.

Figure 1 presents a map of the US depicting the four ABI regions. It is color coded to show expanding billings and increased growth in green and declining billings and negative growth in red. The data is shown on this map is as three month moving averages (3MMA), and 3 month year on year (y/y), percent change.

On a 3MMA basis, the U.S. ABI score was 53.0 with a 1.2% growth y/y. The Southern zone scored the highest 3MMA ABI with 54.9. Its growth rate was flat y/y. The Midwest recorded a 52.0, 3MMA ABI and the strongest y/y growth rate at 5.6%. The West recorded a 3MMA of 52.1 and a 3.0% y/y growth rate. The Northeast posted a 50.5, 3MMA ABI, and 2.8% y/y growth.

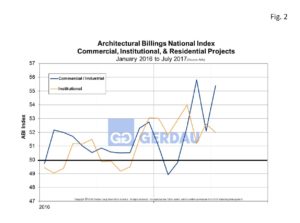

Figure 2  charts the ABI sub-index for Commercial / Industrial and Institutional from 2016 to present. The Commercial/Industrial sub-index jumped 3.3 points to 55.6 in July as the private construction sector continued to gain strength. The index has been greater than 50 for 18 consecutive months. The Institutional scored a 52.0, down 0.6 percentage point, its ninth month in a row greater than the 50 threshold.

charts the ABI sub-index for Commercial / Industrial and Institutional from 2016 to present. The Commercial/Industrial sub-index jumped 3.3 points to 55.6 in July as the private construction sector continued to gain strength. The index has been greater than 50 for 18 consecutive months. The Institutional scored a 52.0, down 0.6 percentage point, its ninth month in a row greater than the 50 threshold.

Kermit Baker, the Chief Economist of the American Institute of Architects, (AIA) commented in today’s press release that: “The July figures show the continuation of healthy trends in the construction sector of our economy. In addition to the balanced increases in design billings across all major regions and construction sectors, the strong gains in new project work coming into architecture firms, points to future growth in design and construction activity over coming quarters.”

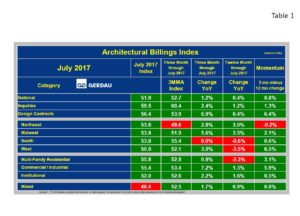

Table 1 lists the overall ABI and all of its sub-indexes. It presents and compares monthly and 3MMA data, showing percentage point change on both three and 12 month basis, as well as momentum. Green denotes positive change, while red indicates negative growth. National momentum (3 month y/y subtract 12 month y/y), was a positive 0.8%, Inquiries momentum +1.6% and Design contracts up an very encouraging 6.4%. Regionally, three of the four zones posted positive momentum. The Northeast was the lone exception with a slight (-0.2%) negative value. Multi-family residential Commercial / Industrial and Institutional project sub-indexes all recorded positive momentum.

Table 1 lists the overall ABI and all of its sub-indexes. It presents and compares monthly and 3MMA data, showing percentage point change on both three and 12 month basis, as well as momentum. Green denotes positive change, while red indicates negative growth. National momentum (3 month y/y subtract 12 month y/y), was a positive 0.8%, Inquiries momentum +1.6% and Design contracts up an very encouraging 6.4%. Regionally, three of the four zones posted positive momentum. The Northeast was the lone exception with a slight (-0.2%) negative value. Multi-family residential Commercial / Industrial and Institutional project sub-indexes all recorded positive momentum.

Construction employment increased by 6,000 jobs in July to 6,899,000 people, its highest level since October 2008. On a year on year basis construction employment increased by 248,000 people, a 3.7% annual growth rate. Overall the July ABI report was very favorable.

At Gerdau we follow the ABI because it is a leading indicator of non-residential construction activity. The ABI has a proven track record and as such it is useful for business planning purposes.