All Long Product Import Licenses

All longs licenses year to-date (YTD), through December 27th totaled 5.476 million tons, (Mt) down 9.5% from last year’s YTD total of 6.053Mt. December to-date license requests were for 260,964 tons, 43% lower than the YTD average of 456,333 tons.

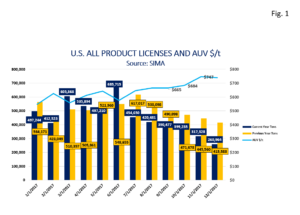

Figure 1 shows total all longs licenses through December for both 2016 and 2017 as reported by the Steel Import Monitoring System (SIMA). Imports have been steadily declining since June. Over the same timeframe prices, (AUV $/t) have been rising.

Figure 1 shows total all longs licenses through December for both 2016 and 2017 as reported by the Steel Import Monitoring System (SIMA). Imports have been steadily declining since June. Over the same timeframe prices, (AUV $/t) have been rising.

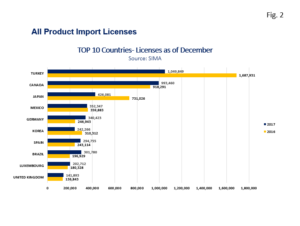

Figure 2  charts the YTD total by country for 2016 and 2017.

charts the YTD total by country for 2016 and 2017.

Turkey licensed the largest amount of longs to the U.S. market in both 2016 and 2017. Its volume plummeted from 1.688Mt in 2016 to 1.049MT in 2017, a 37.8% year on year, (y/y) decline. Turkey’s primary long product export to the U.S is rebar (largest) but it also sent significant quantities of wire rod (5th largest) and merchant products (4th largest) as well.

Canada was the second largest with 0.993Mt in 2017, a 10.5% y/y increase from 2016s 0.918Mt. Canada’s main U.S. long exports are wire rod (largest), merchant products (2nd largest), beams (6th largest) and SBQ (3rd largest).

Japan ranked third with 0.426Mt in 2017, down 41.7% from 0.731Mt in 2016. Japan’s principal long export to the U.S. market was merchants (3rd largest), rebar (2nd largest) and wire rod (2nd largest). Its participation in rebar fell by 92% y/y.

Mexico licensed 0.352Mt in 2017 down 2.2% from the 0.360Mt in 2017. Mexico’s primary licensed longs are beams (4th largest), merchants (2nd largest) and wire rod (10th largest).

Germany’s long exports increased by 37.6% y/y from 0.247Mt in 2016 to 0.340Mt in 2017. Germany’s main long exports are SBQ (largest) beams (9th largest), merchants (5th largest) and wire rod (6th largest).

Korea in the sixth spot sent 0.242Mt in 2017 down 21.9% y/y from the 0.310Mt licensed in 2016. Korea’s main long exports to the U.S. market include; Beams (largest), merchants (7th largest) and SBQ (10th largest).

Spain licensed 0.295Mt of longs in 2017 increasing its tonnage by 21.3% y/y from the 0.243Mt exported in 2016. Spain’s’ principal long exports are beams (3rd largest), merchants (9th largest) SBQ (5th largest) and rebar (3rd largest). Spain’s rebar exports soared 20 fold in 2017.

Brazil sent 0.302Mt longs in 2017, up from 0.197Mt in 2016, a 53.3% y/y jump. Brazil’s main long exports are merchants (10th largest), rebar (6th largest) and SBQ (8th largest).

Luxembourg licensed 0.203Mt in 2017, up 12.8% from its 0.180Mt in 2016. Luxembourg principal exported long product is beams (2nd largest).

Rounding out the top ten long product exporters to the U.S. market is the United Kingdom. The UK sent 0.142Mt in 2017 up 3.6% from the 0.137Mt recorded in 2016. The UKs main long export to the U.S. is beams (5th largest), merchants (6th largest) and SBQ (9th largest).

At Gerdau we closely follow trade in long products steel since it has a profound impact on domestic market share and material pricing. We want you, our valued customers to have access to current information that can help you better plan and operate your businesses.