Advanced Durable Goods Orders

The U.S. Census Bureau reported yesterday that; new orders for durable goods orders fell 3.7% in January. This was far worse that analyst’s consensus expectations and the first decline since October. Most of the weakness was in the volatile nondefense aircraft and defense sector. In addition, the December growth rate was revised 0.3 point lower to +2.6%.

The Advance Report on Durable Goods (DG), provides statistics on manufacturers' value of shipments, new orders, end-of-month unfilled orders and total inventory. Data are collected and tabulated by six-digit NAICS (North American Industry Classification System). The M3 is based upon data reported from manufacturing establishments with $500 million or more in annual shipments. Units October be divisions of diversified large companies, large homogenous companies, or single-unit manufacturers in 89 industry categories.

Capital goods orders were down 5.1%, but are higher by 9.9% on a y/y basis. Non-defense orders fell by 1.5% but posted a 12.2% gain y/y. If transportation is ignored, new orders fell 0.3% but were up by 9.1% on a year on year, (y/y) comparison. Transportation orders were off 10% month on month, but were stronger by 8.4% on a y/y comparison. Non-defense aircraft orders tumbled 28% m/m but have surged 86% y/y. Automobile sales are now tracking below last year’s performance, despite a 0.6% rise in January, while orders for auto parts were higher by 7.3% vs. a year ago. Orders in the manufacturing sector were mixed. Orders for primary metal were down 0.9% m/m but are up 13.3% y/y. Machinery orders fell 0.4% compared to December but have gained 9.8% y/y.

Total durable goods shipments increased by 0.2% and advanced 8.2% y/y. Excluding transportation shipments gained 0.1% m/m and increased by 8.8% y/y. Capital core shipments ticked-up 0.1% and were stronger by 10.8% on a y/y comparison. Looking at the core capital on data on a three month annualized basis, shipments were up 8.3% as orders advance 3.7%.

Durable goods inventory was up 0.3% m/m and higher by 4.3% y/y.

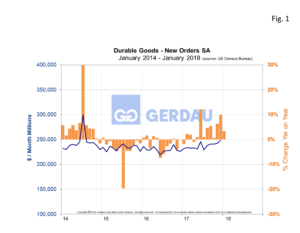

Figure 1 shows the three month moving average, (3MMA) history of DG orders from 1992 to present. The left Y axis presents DG orders in millions of dollars, while the right Y axis shows y/y percentage change. New orders totaled $243.7M in January, (3MMA), from $228.7M a year ago, a 6.6% increase y/y.

Figure 1 shows the three month moving average, (3MMA) history of DG orders from 1992 to present. The left Y axis presents DG orders in millions of dollars, while the right Y axis shows y/y percentage change. New orders totaled $243.7M in January, (3MMA), from $228.7M a year ago, a 6.6% increase y/y.

Despite the roll-back in new orders in January, the upward trend for manufacturing remains intact. The immediate future looks bright, helped by additional stimulus from the recent tax overhaul. Companies will benefit from 14 percent lower corporate taxes as well as the provision to expense equipment costs immediately. This will be especially beneficial to the construction and energy companies which purchase a great deal of large equipment. We also eagerly await the potential passage of a significant infrastructure spending bill which seems to have bipartisan support.

At Gerdau, we routinely monitor durable goods orders since it provides a good read on the current health of the US manufacturing economy and its probable short-run future.