Advanced Durable Goods Orders

The U.S. Census Bureau reported today that; new orders for durable goods orders increased $7.0 billion or 2.9% to $249.4B in December. New orders have increased in four of the past five months. November durable goods orders were revised upwards to +1.7% month on month. Shipments of manufactured goods advanced by 0.6% in December to $246.8B on the heels of a 1.3% rise in November. Fabricated metal products have posted increases in seven of the past eight months and were a significant contributor to the increase.

The Advance Report on Durable Goods (DG), provides statistics on manufacturers' value of shipments, new orders, end-of-month unfilled orders and total inventory. Data are collected and tabulated by six-digit NAICS (North American Industry Classification System). The M3 is based upon data reported from manufacturing establishments with $500 million or more in annual shipments. Units October be divisions of diversified large companies, large homogenous companies, or single-unit manufacturers in 89 industry categories.

Unfilled orders for manufactured DG in December have been higher for four consecutive months. Dollar volume of unfilled orders increased by $6.9B or 0.6% to $1,144B. Transportation equipment was the major contributor, moving-up $6.0B or 0.8%.

Inventories of manufactured DG increased in December, up in 17 of the last 18 months. The increase in December was $1.3B or 0.3%. Machinery was the big driver. Machinery has advanced for 10 of the past 11 months and now stands at $70.4B.

Core capital goods, (non-defense) orders fell $0.1B or 0.1% to $75.1B in December as shipments declined $0.3B or 0.4% to $74.3B.

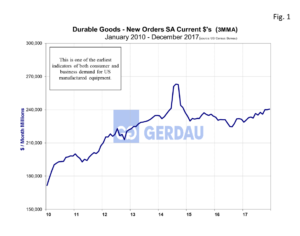

Figure 1 shows the three month moving average, (3MMA) history of DG orders from 2010 to present. The left Y axis presents DG orders in millions of dollars, while the right Y axis shows y/y percentage change. New orders totaled $244.8M in December, (3MMA), from $230.6M a year ago, a 6.1% increase y/y.

Figure 1 shows the three month moving average, (3MMA) history of DG orders from 2010 to present. The left Y axis presents DG orders in millions of dollars, while the right Y axis shows y/y percentage change. New orders totaled $244.8M in December, (3MMA), from $230.6M a year ago, a 6.1% increase y/y.

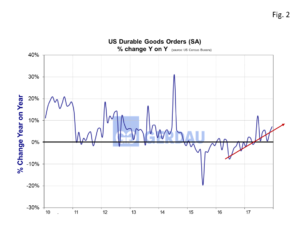

Figure 2 shows percentage change y/y from 2010 to present. After a stubborn period of negative y/y percentage change between January 2015 and January 2017, the situation has reversed and is now trending steadily higher, (red line).

shows percentage change y/y from 2010 to present. After a stubborn period of negative y/y percentage change between January 2015 and January 2017, the situation has reversed and is now trending steadily higher, (red line).

Today’s advance DG report shows that factory conditions continue to expand. Shipments improved and there was positive news for fabricated metal producers. A healthy labor market is expected to drive wages higher, which in-turn will support even stronger consumer spending. In addition, the U.S. dollar hit a three year low yesterday. The depreciated $US dollar helps U.S. manufacturers increase exports while at the same time is retarding imports.

At Gerdau, we routinely monitor durable goods orders since it provides a good read on the current health of the US manufacturing economy and its probable short-run future.