Advanced Durable Goods Orders

New orders for durable goods orders surprised to the upside coming in at 2.2% in September. The change this month was mainly in the non-defense aircraft segment which surged by double digits. Additionally, the critical non-defense capital goods orders, (which exclude the volatile defense and aircraft segments) posted a 1.3% increase month on month, (m/m) as shipments rose 0.7%. On a year to date, (YTD) year on year, (y/y) comparison, DG increased by 4.6%.

The Advance Report on Durable Goods (DG), provides statistics on manufacturers' value of shipments, new orders, end-of-month unfilled orders and total inventory. Data are collected and tabulated by six-digit NAICS (North American Industry Classification System). The M3 is based upon data reported from manufacturing establishments with $500 million or more in annual shipments. Units September be divisions of diversified large companies, large homogenous companies, or single-unit manufacturers in 89 industry categories.

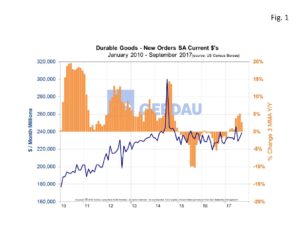

Figure 1 shows the three month moving average, (3MMA) history of DG orders from 2010 to present. The left Y axis presents DG orders in millions of dollars, while the right Y axis shows y/y percentage change. New orders totaled $233.8M in September, (3MMA), from $228.2M a year ago.

Figure 1 shows the three month moving average, (3MMA) history of DG orders from 2010 to present. The left Y axis presents DG orders in millions of dollars, while the right Y axis shows y/y percentage change. New orders totaled $233.8M in September, (3MMA), from $228.2M a year ago.

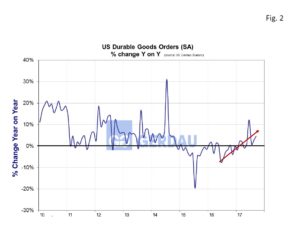

Figure 2 shows percentage change y/y from 2010 to present. After a stubborn period of negative y/y percentage change between January 2015 and January 2017, the situation has reversed and is now trending steadily higher, (red line).

shows percentage change y/y from 2010 to present. After a stubborn period of negative y/y percentage change between January 2015 and January 2017, the situation has reversed and is now trending steadily higher, (red line).

Transportation orders moved-up 5.1% m/m and was up 5.5% y/y. The nondefense aircraft component was the main source of volatility in the numbers. September orders for nondefense aircraft jumped 31.5% m/m and was up by 38.1% y/y as Boeing received 72 new orders.

Motor vehicles gained 0.1% m/m, while more importantly the August number was revised upward by 2.8%. On a y/y basis, motor vehicles and parts orders were lower by 0.9%. A stronger than anticipated global economy coupled with a lower dollar have combined to offset the expected softness from banks pulling-back on subprime loans. Other manufacturing industries reports were mixed. Orders for primary metals were down 0.1% m/m but were stronger by 10.9% y/y. Machinery orders fell 0.2% m/m. Total shipments of DG increased 1.0% m/m and by 3.4% y/y, while core capital goods shipments increased by 0.7% m/m and by 5.9% y/y. Durable goods inventories rose 0.6% and are up 3.4% y/y.

Despite the disruptions caused by the hurricanes, the economy continued to perform well in September. Business sentiment remains robust and expectations are that manufacturing will continue to gain strength. The Purchasers Manger’s Index posted a score of 60.8, up 2.0 points month on month, (m/m) surpassing analysts’ expectations and corroborating the positive news in this months’ DG report. In addition the Industrial Production Index is trending upward. Manufacturers are generally upbeat on the future and plan to expand operation if tax reform passes. A softer dollar is helping exporters ship more product abroad and narrowing the trade deficit. The trade deficit narrowed to $42.4B in August, down $1.2B from July. Exports for the month were $195.3 billion, while imports came to $237.7B. The nation’s trade deficits with China and the European Union both shrank in August.

At Gerdau, we routinely monitor durable goods orders since it provides a good read on the current health of the US manufacturing economy and its probable short-run future.