Advanced Durable Goods Orders

After a disappointing month in July, August advanced durable goods orders rebounded in August rising 1.7%. On a year to date, (YTD) year on year, (y/y) comparison, DG increased by 5.1%. The change this month was mainly in the non-defense aircraft segment. However, the critical non-defense capital goods orders segment posted a 0.9% month on month, (m/m) gain.

The Advance Report on Durable Goods (DG), provides statistics on manufacturers' value of shipments, new orders, end-of-month unfilled orders and total inventory. Data are collected and tabulated by six-digit NAICS (North American Industry Classification System). The M3 is based upon data reported from manufacturing establishments with $500 million or more in annual shipments. Units August be divisions of diversified large companies, large homogenous companies, or single-unit manufacturers in 89 industry categories.

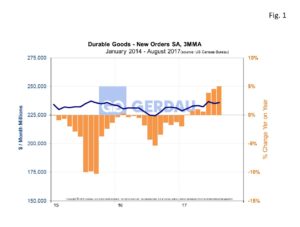

Figure 1 shows the three month moving average, (3MMA) history of DG orders from 2015 to present. The left Y axis presents DG orders in millions of dollars, while the right Y axis shows y/y percentage change. New orders totaled $235.9M in August, (3MMA), up from $225.5M a year ago.

Figure 1 shows the three month moving average, (3MMA) history of DG orders from 2015 to present. The left Y axis presents DG orders in millions of dollars, while the right Y axis shows y/y percentage change. New orders totaled $235.9M in August, (3MMA), up from $225.5M a year ago.

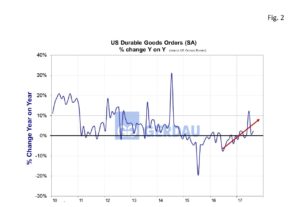

Figure 2  shows percentage change y/y from 2010 to present. After a stubborn period of negative y/y percentage change between January 2015 and January 2017, the situation has reversed and is trending higher, (red line).

shows percentage change y/y from 2010 to present. After a stubborn period of negative y/y percentage change between January 2015 and January 2017, the situation has reversed and is trending higher, (red line).

Transportation orders moved-up 2.6% m/m and were up 7.2% y/y. The nondefense aircraft component was the main source of volatility in the numbers. August orders for nondefense aircraft jumped 44.8% m/m and were up by 63.3% y/y. Motor vehicles and parts orders gained 1.5% m/m bouncing back from a down month in July. On a y/y basis motor vehicles and parts orders were higher by 0.9%. If transportation orders are excluded the gain for DG falls to +0.2% m/m and up 5.9% y/y.

Other manufacturing industries reported generally positive news. Orders for primary metals were up 1.7% m/m and were stronger by 11.9% y/y. Machinery orders moved-up 1.1% for the month and by 6.4% y/y. Total shipments of DG increased 0.3% m/m and by 4.6% y/y, while core capital goods shipments increased by 0.7% m/m and by 6.4% y/y. Durable goods inventories rose 0.3% and are up 2.7% from a year earlier.

The August DG report confirms that business sentiment remains solid. Expectations are that manufacturing will continue to gain strength. An added boost is expected through the reminder of the year and into 2018 as household and businesses rebuild from the extensive damage caused by the hurricanes. Despite two failed attempts at healthcare reform in Congress, businesses remain upbeat, anticipating corporate tax relief from Washington DC. Sketchy details today indicated that corporate tax may be slashed from 35% to 20%.

At Gerdau, we routinely monitor durable goods orders since it provides a good read on the current health of the US manufacturing economy and its probable short-run future.