Advanced Durable Goods Orders

Overall, durable goods orders have improved, up 4.6% year on year, (y/y). However for the month of July, new orders tumbled 6.8% month on month, (m/m), largely as a function of sharply reduced non-defense aircraft, autos and machine orders. If transportation orders are excluded, orders were up by 0.5% and were 6.9% higher y/y.

The Advance Report on Durable Goods (DG), provides statistics on manufacturers' value of shipments, new orders, end-of-month unfilled orders and total inventory. Data are collected and tabulated by six-digit NAICS (North American Industry Classification System). The M3 is based upon data reported from manufacturing establishments with $500 million or more in annual shipments. Units July be divisions of diversified large companies, large homogenous companies, or single-unit manufacturers in 89 industry categories.

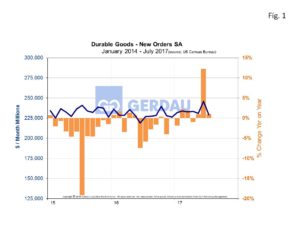

Figure 1 shows the history of DG orders from 2015 to present. The left Y axis presents DG orders in millions of dollars, while the right Y axis shows y/y change. Orders for DG have historically shown wild swings from month to month, June and July 2017 are a case on point.

Figure 1 shows the history of DG orders from 2015 to present. The left Y axis presents DG orders in millions of dollars, while the right Y axis shows y/y change. Orders for DG have historically shown wild swings from month to month, June and July 2017 are a case on point.

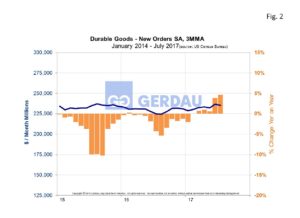

Figure 2  presents the identical chart with 3MMA resulting in significant smoothing. On 3MMA basis, new orders for DG, were down 0.6% m/m at $235.3 billion. On a 3MMA y/y assessment, DG orders advanced by 4.6%.

presents the identical chart with 3MMA resulting in significant smoothing. On 3MMA basis, new orders for DG, were down 0.6% m/m at $235.3 billion. On a 3MMA y/y assessment, DG orders advanced by 4.6%.

Transportation orders fell 19% m/m and were down 0.7% y/y. The nondefense aircraft component was the main source of weakness, plunging 71% m/m and 32% y/y. This was a huge swing from June, when Boeing received a very large order causing the monthly and yearly numbers to spike 132% m/m and 275% y/y. Motor vehicles and parts orders lost 1.2% m/m are were down 1.1% y/y. Some of this can be attributed to the retooling cycle, however concerns surrounding sub-prime auto loans is impacting sales as banks pull-back on this type of financing.

Data was mixed in the manufacturing sector. Orders for primary metals were flat m/m but were up 11% y/y. Shipments for capital goods increased 1% m/m and by 7% y/y. This category is especially important because it impacts the quarterly GDP calculations. Durable goods inventories rose 0.3% and were up 2.3% from a year earlier.

Overall business sentiment remains upbeat but policy uncertainty has started to create concern. Durable goods producers are counting on corporate tax reform, regulation modification and a significant infrastructure spending bill to be passed. These policy agenda items have been priced these into DG producer’s business plans. Healthy consumer and business confidence and its resultant spending could begin to wane if these important policy agenda initiatives are not acted upon over the next few months. All eyes are on Capitol Hill to see what’s next.

At Gerdau, we routinely monitor durable goods orders since it provides a good read on the current health of the US manufacturing economy and its probable short-run future.