Advanced Durable Goods Orders

New orders for durable goods (ADG), decreased by 1.1% in May to $228.2 billion. On a three month moving average (3MMA), assessment, ADG was down 1.3% month on month (m/m) and down 0.3% year on year (y/y). The good news is that primary metals advanced 0.3% and were up 12.5% from a year earlier. The pickup in the oil sector has been good for metal products, which have posted healthy gains in 2017.

The Advance Report on Durable Goods (M3), provides statistics on manufacturers' value of shipments, new orders, end-of-month unfilled orders and total inventory. Data are collected and tabulated by six-digit NAICS (North American Industry Classification System). The M3 is based upon data reported from manufacturing establishments with $500 million or more in annual shipments. Units may be divisions of diversified large companies, large homogenous companies, or single-unit manufacturers in 89 industry categories.

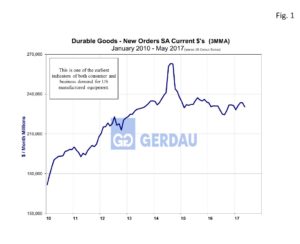

Figure 1 shows the history of durable goods orders from 2010 to present. Figure 2

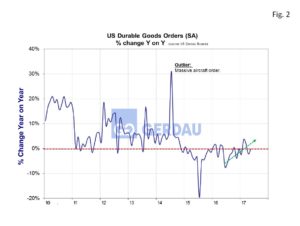

Figure 1 shows the history of durable goods orders from 2010 to present. Figure 2 shows the 3MMA y/y percentage change. The percentage change has been in positive territory for three of the past four months and on an upward trend since mid-2016, (green dotted line).

shows the 3MMA y/y percentage change. The percentage change has been in positive territory for three of the past four months and on an upward trend since mid-2016, (green dotted line).

New orders for durable goods fell more the consensus estimate and this was the second consecutive monthly decline. Most of the decline for this month and last was attributable to a decline in the volatile non-defense aircraft order segment. Excluding transportation, orders rose 0.1% m/m and were up 7.3% y/y. Excluding defense, orders slipped 0.6% and were 4.6% higher from a year earlier. Core capital goods shipments were revised upward from -0.1% to +0.1%. This is significant since it contributes to GDP calculations for Q2. Manufacturing payrolls added a net 11,000 jobs in April, but fell-back 1,000 jobs in May. Businesses remain upbeat by historical standards, however the post-election expectant sentiment has begun to wane. Businesses have been anticipating corporate tax reform as well as a significant infrastructure bill. Focus on Russian involvement into the 2016 prudential election has stalled these important legislative agenda items and future timetable remains unclear.

At Gerdau, we routinely monitor durable goods orders since it provides a good read on the current health of the US manufacturing economy and its probable short-run future.