Advanced Durable Goods Orders

The U.S. Census Bureau reported that; new orders for durable goods orders decreased by 0.2% month on month, (m/m) in August, following the 2.0% increase in July. The always-volatile nondefense aircraft orders, increasing 30.3% m/m and down 3.5% y/y influenced this trend significantly.

The Advance Report on Durable Goods (DG), provides statistics on manufacturers' value of shipments, new orders, end-of-month unfilled orders and total inventory. Data are collected and tabulated by six-digit NAICS (North American Industry Classification System). The M3 is based upon data reported from manufacturing establishments with $500 million or more in annual shipments

Capital goods orders increased by 0.2% for the month and down 3.6% on a year on year, (y/y) basis. Transportation orders decreased by 0.4% and were down 2.4% vs a year ago. Leaving out transportation business, orders remained flat m/m and were up 7.2% y/y.

Motor vehicles and parts were down 0.8% m/m as orders advanced 5.9% y/y. Concern was expressed that steel and aluminum tariffs may add risk to further growth. Orders for primary metal were up 1.5% m/m and have decreased 3.6% y/y.

Durable goods shipments rose 0.1% m/m and were higher by 2.5% on a year on year comparison. Capital goods shipments increased by 0.2% m/m and 1.6% y/y.

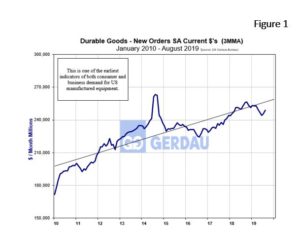

Figure 1 shows the history of DG orders from 2010 to present. New orders totaled $243.4M in May, (3MMA), a 1.0% increase y/y.

Figure 1 shows the history of DG orders from 2010 to present. New orders totaled $243.4M in May, (3MMA), a 1.0% increase y/y.

At Gerdau, we routinely monitor durable goods orders since it provides a good read on the current health of the US manufacturing economy and its probable short-run future.