Advanced Durable Goods Orders

The U.S. Census Bureau reported new orders for durable goods orders declined 2.1% month on month, (m/m) in April. The slowdown was driven by exports and a buildup of inventories. Orders for non-defense capital goods excluding aircraft dropped 0.9% last month as demand weakened almost across the board, the Commerce Department said

The Advance Report on Durable Goods (DG), provides statistics on manufacturers' value of shipments, new orders, end-of-month unfilled orders and total inventory. Data are collected and tabulated by six-digit NAICS (North American Industry Classification System). The M3 is based upon data reported from manufacturing establishments with $500 million or more in annual shipments. Units October be divisions of diversified large companies, large homogenous companies, or single-unit manufacturers in 89 industry categories.

Capital goods orders advanced 5.8% for the month and are higher by 13.2% on a year on year, (y/y) basis. Transportation orders increased 7.1% and were up 11.7% vs a year ago. Leaving out transportation business, orders increased by 1.2% y/y and were up 7.9% y/y.

Economists polled by Reuters had forecast core capital goods orders falling 0.3% in April. Core capital goods orders increased 2.6% on a year-on-year basis. Durable goods orders are also predicted to gain 0.2% in May 2019.

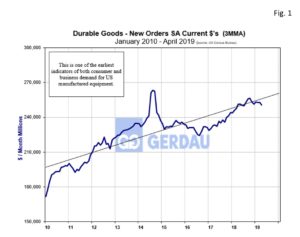

Figure 1 shows the history of DG orders from 2010 to present. New orders totaled $245.7M in February, (3MMA), from $232.8M a year ago, a 5.5% increase y/y.

Figure 1 shows the history of DG orders from 2010 to present. New orders totaled $245.7M in February, (3MMA), from $232.8M a year ago, a 5.5% increase y/y.

The year got off to a slow start with negative growth in January but that data point was more than offset with goof performance in February. The fundamentals remain strong for U.S. factories to thrive amid stronger domestic and global demand. Companies will benefit from fourteen percent lower corporate taxes as well as the provision to expense equipment costs immediately.

At Gerdau, we routinely monitor durable goods orders since it provides a good read on the current health of the US manufacturing economy and its probable short-run future.