U.S. Steel Capacity Utilization

The total tonnage for the week ending January 20th was 1,693 million tons, (Mt) at a capacity utilization rate of 72.6%. For the first three weeks of 2018, total tonnage output was 5,049 Mt, at a capacity utilization rate of 72.2%. In 2017, the same three weeks production total was 5,103 Mt at 71.7%, so we are off to a slower start so far, (-1.1%) in 2018.

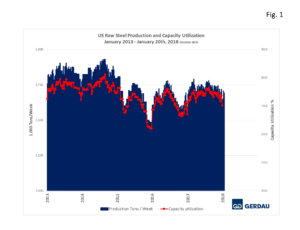

Figure 1 shows production on the left-hand scale and capacity utilization as a percent on the right-hand scale. Capacity utilization and production has been drifting lower for the past several weeks which is typical for the end of the year period.

Figure 1 shows production on the left-hand scale and capacity utilization as a percent on the right-hand scale. Capacity utilization and production has been drifting lower for the past several weeks which is typical for the end of the year period.

Production for the entire year of 2017 was 90,106 Mt, at an average of 1,733 Mt per week with an average capacity utilization of 74.0%. In 2016, the total was 88,463 at an average of 1,701 Mt per week with an average capacity utilization of 71.1%. Summarizing the year over year, (y/y) improvement: +23,000 tons per week, +1,643 Mt total tons, and +2.9 percentage point increase in the capacity utilization rate.

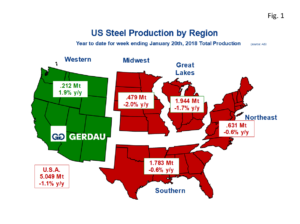

Figure 2 presents a map of the U.S. with its five steel producing zones. The Great Lakes region was the largest steel producing region, with 1.944 Mt through January 20th, down 1.7% y/y. The Southern region was next with 1.783 Mt off 0.6% y/y. At 0.631 Mt, the Northeast region ranked third largest. The Northeast tonnage decreased by 0.6% y/y. The Midwest produced 0.479 Mt, down 2.0% y/y, while the Western zone both produced 0.212 Mt, up 1.9% y/y.

presents a map of the U.S. with its five steel producing zones. The Great Lakes region was the largest steel producing region, with 1.944 Mt through January 20th, down 1.7% y/y. The Southern region was next with 1.783 Mt off 0.6% y/y. At 0.631 Mt, the Northeast region ranked third largest. The Northeast tonnage decreased by 0.6% y/y. The Midwest produced 0.479 Mt, down 2.0% y/y, while the Western zone both produced 0.212 Mt, up 1.9% y/y.

Looking at production on a three month moving total, (3MMT) basis, we see that; The Great Lakes region produced 8,184 Mt, down 7.1% y/y. The Southern zone made 8,245 Mt, up 1.1% y/y. The Northeast region produced 2,678 Mt for a 1.5% increase y/y and the Midwest generated 2,118 Mt, off 2.4% y/y. Total U.S. production, (3MMT) was 22,135 Mt, down 2.4% y/y.

At Gerdau, we track US steel production and capacity utilization to keep an eye on the overall health of the US steel industry. We feel it is important to understand the forces that influence steel demand to include the strength of the US economy and import penetration.