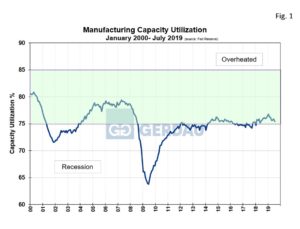

U.S. Manufacturing Capacity Utilization

Manufacturing capacity utilization (MCU), scored a 75.4% in July, down 0.6% month on month (m/m), and down 0.4% year on year (y/y)

Figure 1, charts capacity utilization from 2000 to present. The MCU index is currently in the green zone which is considered to be ideal. After a long run at the bottom of the “green zone”, the index has begun to move higher scoring its second month in a row above 76%.

Figure 1, charts capacity utilization from 2000 to present. The MCU index is currently in the green zone which is considered to be ideal. After a long run at the bottom of the “green zone”, the index has begun to move higher scoring its second month in a row above 76%.

The Federal Reserve on Thursday said manufacturing production shrank 0.4% last month, a steeper drop than the 0.1% decline expected by analysts in a Reuters poll. The data may add to concerns about the strength of the U.S. factory sector amid lingering concerns about a slowing global economy. The July decline was the largest since April.

The Institute of Supply Management’s Index moved down 0.5 points on month, (m/m) to 51.2 for July 2019. This value is an encouraging sign for the manufacturing sector. The index has been greater than 50, (>50 = expansion) for thirty-five consecutive months. The new orders sub-index scored a 50.8. Overall, the ISM manufacturing index is strong and fundamentals remain favorable as the global economy strengthens and the U.S. dollar depreciates.

Of the 18 manufacturing industries, nine reported growth in July, in the following order: Wood Products; Printing & Related Support Activities; Furniture & Related Products; Food, Beverage & Tobacco Products; Plastics & Rubber Products; Computer & Electronic Products; Textile Mills; Petroleum & Coal Products; and Chemical Products. The nine industries reporting contraction in July — in the following order — are: Apparel, Leather & Allied Products; Fabricated Metal Products; Primary Metals; Nonmetallic Mineral Products; Transportation Equipment; Paper Products; Miscellaneous Manufacturing; Electrical Equipment, Appliances & Components; and Machiner.

At Gerdau we regularly monitor the manufacturing capacity utilization date issued by the Federal Reserve because it provides excellent insight into the health of US manufacturing activity. We know that when manufacturing is performing well, so are steel sales and want to keep you our valued customers and readers informed.