Dodge Momentum Index

The Dodge Momentum Index increased 2.9% to 136.7 in December after a sizable downward revision to the November score. On a year on year comparison, the composite index was flat. The commercial sub-indexes posted a significant increases for the month, while the institutional index declined.

The Dodge Momentum Index is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

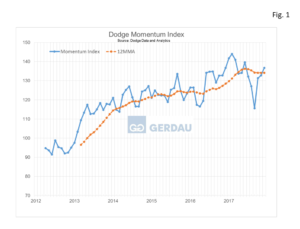

Figure 1 presents the Dodge momentum index and its twelve month moving average, (12MMA) from 2012 to present. The index had fallen for three months through September, creating a concern that a cyclical decline may have begun. The index bounced back in October and has now moved higher for four consecutive months. The 12 month moving average (12MMA) line has posted the identical score, (134.1) for four months in a row. Septembers’ posting of 115.6 now appears to be an outlier.

Figure 1 presents the Dodge momentum index and its twelve month moving average, (12MMA) from 2012 to present. The index had fallen for three months through September, creating a concern that a cyclical decline may have begun. The index bounced back in October and has now moved higher for four consecutive months. The 12 month moving average (12MMA) line has posted the identical score, (134.1) for four months in a row. Septembers’ posting of 115.6 now appears to be an outlier.

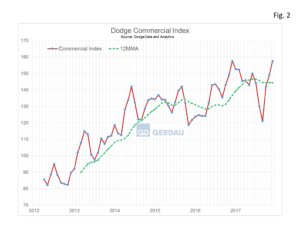

Figure 2 breaks out the commercial sub-index and its 12MMA. The commercial sub-index shows a near mirror-image of the overall momentum image. This is because a significant ratio, (about 75%) of non-residential projects originates from the private sector. The commercial index advanced 8.5 points or 5.7% in December. Similar to the composite index, the 12MMA commercial line has flattened-out over the past four months. The commercial sub-index showed no change on a percentage year on year, (y/y) basis.

breaks out the commercial sub-index and its 12MMA. The commercial sub-index shows a near mirror-image of the overall momentum image. This is because a significant ratio, (about 75%) of non-residential projects originates from the private sector. The commercial index advanced 8.5 points or 5.7% in December. Similar to the composite index, the 12MMA commercial line has flattened-out over the past four months. The commercial sub-index showed no change on a percentage year on year, (y/y) basis.

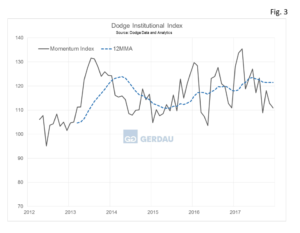

Figure 3  shows the institutional sub-index and its 12MMA. The institutional sub-index fell 1.9 points or -1.7% m/m. The monthly line shows a downward trend, however the 12MMA line remains flat at this point. On a y/y basis the institutional sub-index unchanged.

shows the institutional sub-index and its 12MMA. The institutional sub-index fell 1.9 points or -1.7% m/m. The monthly line shows a downward trend, however the 12MMA line remains flat at this point. On a y/y basis the institutional sub-index unchanged.

December’s gain was due to a 5.7% increase in the commercial component, which more than offset a 1.7% drop in the institutional component. Commercial planning showed solid growth in 2016, climbing 38% y/y. Institutional planning on the other hand declined by 6% after a strong 2015. This points to continued growth for the commercial sector in 2017 despite being at a more mature phase of its cycle. Planning in the institutional sector has yet to see the benefit of the numerous education-related bond measures passed in recent years.

In December, eight projects entered planning each with a value that exceeded $100 million. For the commercial building sector, the leading projects were a $400 million mixed-use building in Atlanta GA, that will include 640,000 square feet of office space and a hotel, and a $351 million office tower in San Francisco CA. The leading institutional projects were a $140 million renovation to the Quicken Loans Arena in Cleveland OH and a $130 million high school in Sherman TX.

At Gerdau we regularly monitor the strong relationship established between the Dodge Momentum Index and actual non-residential construction spending one here hence. This is a valuable leading indicator for planning purposes for construction industry professionals including you our valued customers.