Consumer Confidence

The Consumer confidence index rolled-back 2.3 points in March according to the Conference Board. The index now stands at 127.7. Despite the decline, the index remains at elevated levels with a positive trend line. Businesses report being somewhat more pessimistic about current conditions as expectations fell across the board. On the other-hand, the labor market continues to post impressive gains and workers remain confident about their future. On a year over year comparison, the 3MMA composite index was up 9.7 points or 8.3%.

The Consumer Confidence Survey measures the level of confidence individual households have in the performance of the economy. Survey asks a nationwide representative sample of 5,000 households, of which approximately 3,500 responses. Households are asked five questions that include (1) a rating of business conditions in the household’s area, (2) a rating of business conditions in six months, (3) job availability in the area, (4) job availability in six months, and (5) family income in six months that go into the top line index.

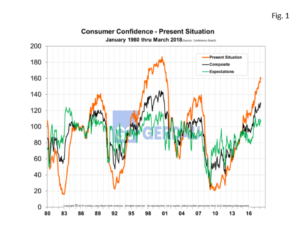

Figure 1 shows the Composite, Present and Expectation indexes from 1980 to present. The Present Situation score fell 1.3 points month on month, (m/m) to 159.9 and was stronger by 16.0 points or 11.1% y/y. The Expectation score dumped 6.1 points m/m to 106.2. Looked at on a y/y basis, the expectation index was off 6.1 points or -5.4%.

Figure 1 shows the Composite, Present and Expectation indexes from 1980 to present. The Present Situation score fell 1.3 points month on month, (m/m) to 159.9 and was stronger by 16.0 points or 11.1% y/y. The Expectation score dumped 6.1 points m/m to 106.2. Looked at on a y/y basis, the expectation index was off 6.1 points or -5.4%.

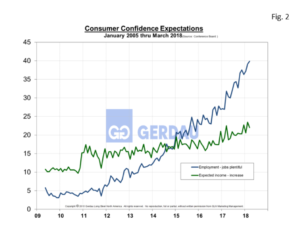

Figure 2  chart two sub-indexes, Employment – jobs plentiful, (blue-line) and expected income – increase, (green-line). The 3MMA jobs plentiful index gained 1.2 points m/m to 38.7%. Those who saw jobs harder to get, (3MMA) fell 0.4 point to 15.4%. The expectation of higher wages index declined by 0.2 points to 5.3%, while those expecting an income decrease was down 0.6 point to 10.5%.

chart two sub-indexes, Employment – jobs plentiful, (blue-line) and expected income – increase, (green-line). The 3MMA jobs plentiful index gained 1.2 points m/m to 38.7%. Those who saw jobs harder to get, (3MMA) fell 0.4 point to 15.4%. The expectation of higher wages index declined by 0.2 points to 5.3%, while those expecting an income decrease was down 0.6 point to 10.5%.

Purchasing plans were down across the board, with potential home buyers moving down 1.7 points to 5.5% and appliance buyers falling 3.2 points to 48.9%. Those planning to purchase an automobile over the next six months fell 0.7 point to 12.9%. Despite the highest consumer confidence in years, purchasing plans for cars and houses are depressed compared with a year ago.

Sentiment was lower in all cohort groupings, with the under 35 group posting the largest decrease, off 11 points m/m and down 10.4 points form a year ago. The 55 and older cohort was lower by two ticks in March, but up 10.3 points y/y. The middle-age cohort lost 3 points m/m, but edged 0.2 points higher on y/y basis. From a household income perspective, those in the $25,000 to $50,000 earnings range reported higher confidence levels, while higher-income earners, (>$75,000) reported lower confidence levels over the past three months.

The economy continues to be strong with additional growth expected over the next couple of years aided by the tax cuts and increased federal government spending. Unemployment levels are headed down to levels never witnessed before, headed towards 3%. The labor force participation ratio may break out shortly as idled workers respond to the record number of open job positions and accelerating wage growth. Concern continues that this situation may is not sustainable, that the economy will overheat, resulting in rising prices. This triggers rapid interest rate hikes to cool things down.

At Gerdau we routinely monitor consumer confidence, readily available credit and spending habits since we know that increased consumer spending translates to stronger steel sales and vice versa.