Advanced Durable Goods Orders

The U.S. Census Bureau reported yesterday that; new orders for durable goods orders gained 3.1% month on month, (m/m) in February, good news after the disappointing 3.5% decline in January. The always volatile nondefense aircraft orders, adding 25.5% m/m. Orders in the important core capital goods segment rose 1.8% m/m, the largest increase since September. Shipments gained 0.9% m/m and have been positive for over a year. Core capital goods shipments rose 1.4% continuing their steady rise.

The Advance Report on Durable Goods (DG), provides statistics on manufacturers' value of shipments, new orders, end-of-month unfilled orders and total inventory. Data are collected and tabulated by six-digit NAICS (North American Industry Classification System). The M3 is based upon data reported from manufacturing establishments with $500 million or more in annual shipments. Units October be divisions of diversified large companies, large homogenous companies, or single-unit manufacturers in 89 industry categories.

Capital goods orders advanced 5.8% for the month and are higher by 13.2% on a year on year, (y/y) basis. Transportation orders increased 7.1% and were up 11.7% vs a year ago. Leaving out transportation business, orders increased by 1.2% y/y and were up 7.9% y/y.

Motor vehicles and parts were up 1.6% as orders advanced 7.1% y/y. Concern was expressed that steel and aluminum tariffs may add risk to further growth. Orders for primary metal were up 2.7% and have increased 13.3% on a y/y metric. New machinery orders were also higher, increasing 1.6% m/m and 9.7% y/y.

Durable goods shipments rose 0.9% m/m and were higher by 7.4% on a year on year comparison. Capital goods shipments increased by 1.4% m/m and 7.4% y/y. Inventories of DG rose by 0.4% and increased 4.7% from a year earlier. Rising inventories will show-up as stronger GDP growth in the first quarter.

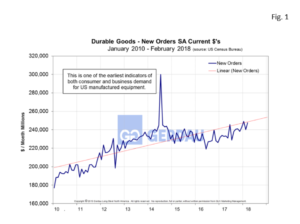

Figure 1 shows the history of DG orders from 2010 to present. New orders totaled $245.7M in February, (3MMA), from $232.8M a year ago, a 5.5% increase y/y.

Figure 1 shows the history of DG orders from 2010 to present. New orders totaled $245.7M in February, (3MMA), from $232.8M a year ago, a 5.5% increase y/y.

The year got off to a slow start with negative growth in January but that data point was more than offset with goof performance in February. The fundamentals remain strong for U.S. factories to thrive amid stronger domestic and global demand. Companies will benefit from fourteen percent lower corporate taxes as well as the provision to expense equipment costs immediately.

At Gerdau, we routinely monitor durable goods orders since it provides a good read on the current health of the US manufacturing economy and its probable short-run future.